Gerson - Juego de 2 macetas Colgantes de Cactus de Metal galvanizado para decoración del suroeste: Amazon.es: Jardín

Ayuda a Encontrar 2 Cactus Idénticos Juego De Rompecabezas Lógico Para Niños Y Adultos Página Impresa Para Niños Libro De Bromas Ilustración del Vector - Ilustración de imagen, correspondiente: 166756950

Juego de tapones de silicona para botellas de vino, Juego de 2 unidades de tapones de Cactus, dijes de Cactus verde, Marke de vidrio multicolor|Otros accesorios para bar| - AliExpress

Alfombras de tapiceria Cactus 2 - Nature - Juego rectangular de 2 piezas - Antideslizante, suave - Multicolor en Micro

Cactus mccoy 2: las ruinas de calavera stickman y hacha vikingos stickman hacha de lucha, hacha, juego, arma png | PNGEgg

Estudios de flipline cactus mccoy 2: las ruinas de calavera papa taco mia hd juego papa hd de papa, hotcake, flipline, estudios, cactus png | PNGWing

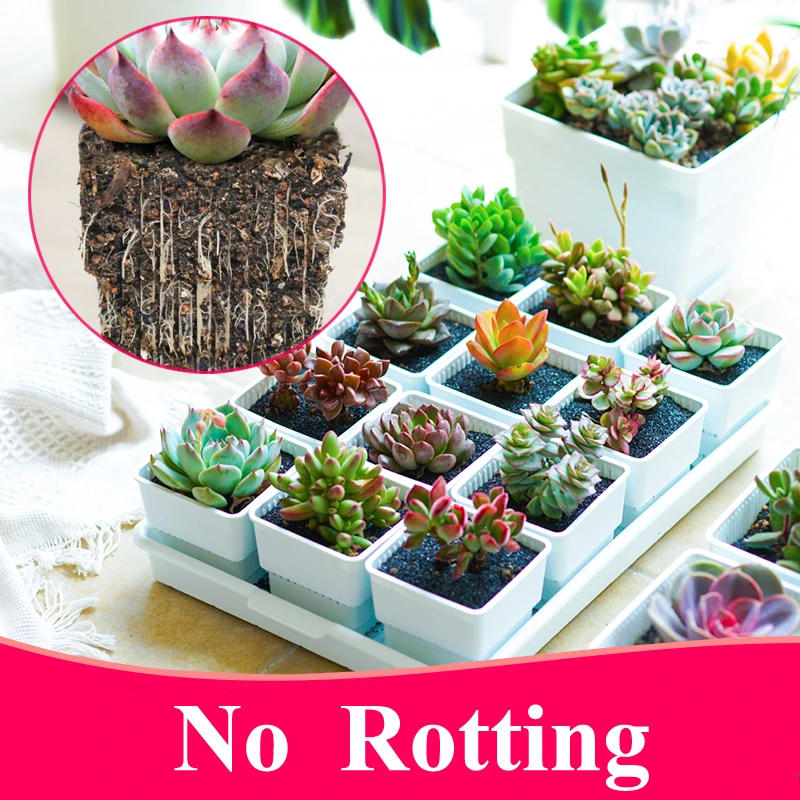

Meshpot maceta cuadrada de plástico para plantas suculentas, juego de bandejas, maceta para guardería, maceta para plantas de Cactus, maceta para jardín, 2, 3 y 4 pulgadas|Macetas y jardineras| - AliExpress