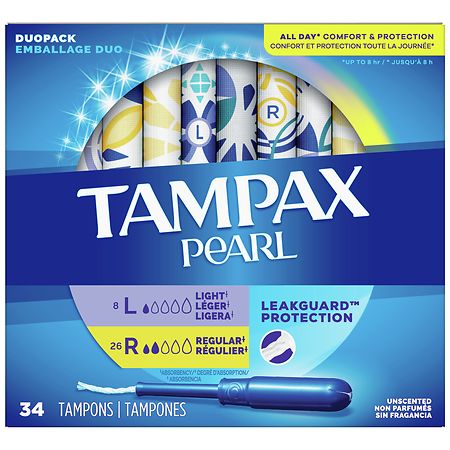

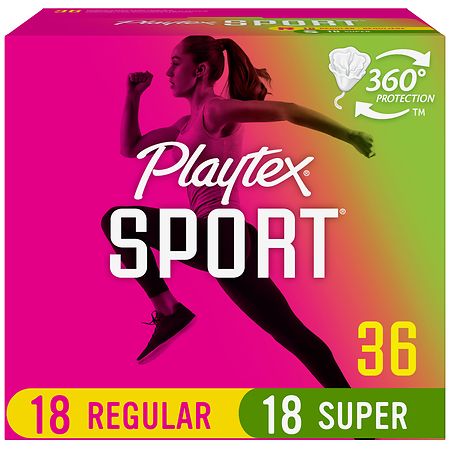

Amazon.com: Playtex Sport Tampons, Multipack (24ct Regular/24ct Super Absorbency), Fragrance-Free - 48ct : Health & Household

Machine De Tampon Personalized Ink Pad and Tampons Suzuki Sx4 Vaginal Used Tampons for Sale - China Tampon Dispenser Ultra Tampons and Organic Tampon price | Made-in-China.com

The Denver City Council just moved to scale back a sexist 'tampon tax' - Denverite, the Denver site!

Source organic used tampons for sale NOT reusable BPA-Free Plastic Compact Applicator Chlorine & Toxin Free on m.alibaba.com

Chaya - TAMPONS FOR SALE!! Tampons with applicator 20pcs per box Available sizes 🌸 Super 🌸 Regular Limited stocks only! | Facebook