GEOX AMPHIBIOX ZAPATILLA ANIMAL-PRINT MUJER IMPERMEABLE TRANSPIRABLE BACKSIE ABX D94FPB 01122 C6T6M MARRÓN GEOX051

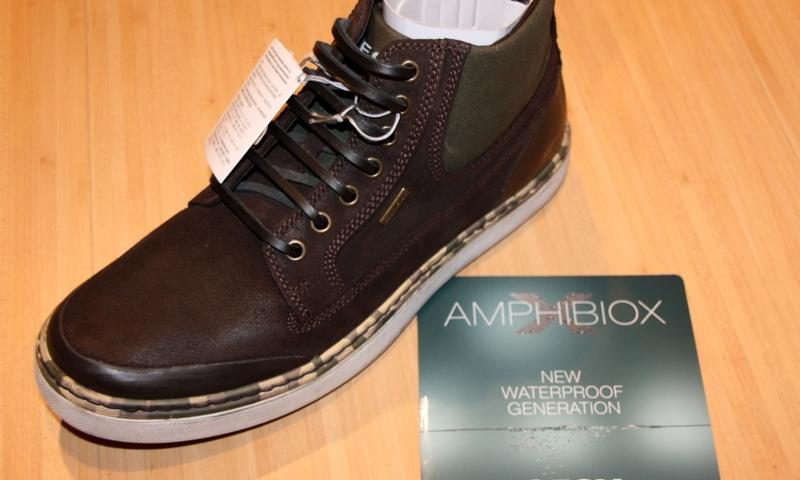

AERANTIS AMPHIBIOX de GEOX: zapatillas impermeables, adaptadas a cualquier condición atmosférica | UEStudio

Zapatillas de mujer en negro bajas tipo running impermeables con tecnología Amphibiox · Geox · El Corte Inglés

Zapatillas de mujer en azul marino bajas tipo running con tecnología Amphibiox y sistema Zero-Shock · Geox · El Corte Inglés

AERANTIS AMPHIBIOX de GEOX: zapatillas impermeables, adaptadas a cualquier condición atmosférica | UEStudio